Blog

Revolutionising producer livelihoods: opportunities for digital financial and information services to build resilience in Ethiopia

Digital financial and information services can transform the livelihoods of agro producers across Ethiopia. This blog - based on a SPARC, Dalberg Research and Mercy Corps AgriFin event - explains how.

Publisher SPARC

The second in a series of webinars by SPARC, Mercy Corps AgriFin and Dalberg Research on ways smallholder agricultural producers in Ethiopia use digital information and financial services upheld the positive narrative of growth and potential that can be realised through increased access to and use of these digital services.

The online event, held last September, saw the launch of the report Access and Utilisation of Digital Financial Services (DFS) and Digital Information Services (DIS) among Smallholder Farmers, Pastoralists and Agropastoralists in Ethiopia, based on research by Dalberg Research, and supported by SPARC and Mercy Corps AgriFin. Panellists took part in vibrant discussions with the audience and answered many of their important questions:

Q: “What are the challenges in the adoption of digital technologies in Ethiopia?”

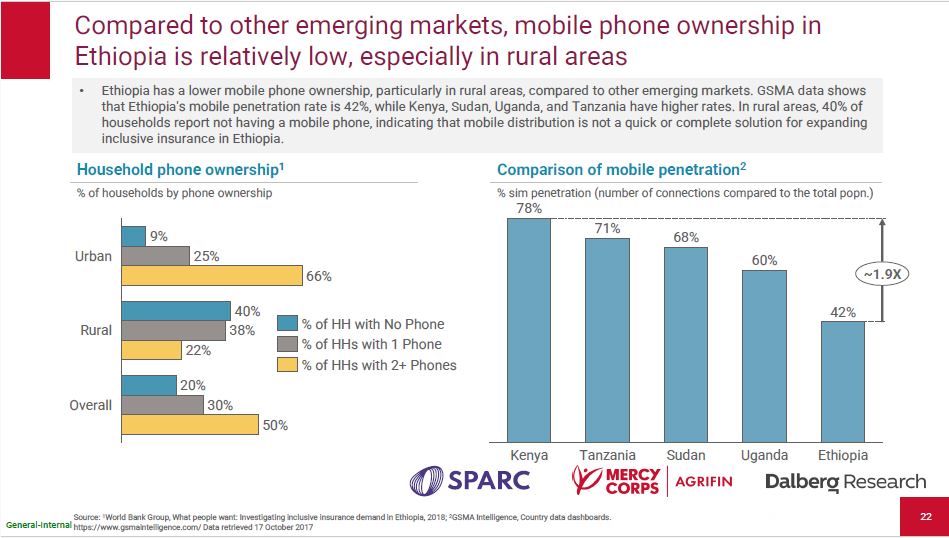

A: According to the research, poor infrastructure, the prohibitive cost of internet and digital devices, and low literacy and digital literacy levels hamper producers from using digital extension and advisory services. Many farmers in Ethiopia do not have the skills to use digital information and financial services effectively, so require additional training and support. Elias Nure, panellist and Global Digital Climate Smart Agriculture Director, Mercy Corps AgriFin, pointed out that as well as the uneven distribution of the mobile and internet network across Ethiopia, there is limited capacity of mobile networks resulting in poor quality connection. He added that the 3G network is overused while there is limited access to 4G. He also highlighted that the cost of mobile devices and data is higher than in other countries in the region.

Mr Nure added that trust is also a factor. The research found that 62% of the rural population is concerned about unexpected expenses linked to bank accounts. This further compounds the disparity in awareness levels where only 4% of the rural population knows about mobile banking, compared with 53% of the urban population.

Q: "What steps are being taken towards resolving the prevailing challenge?"

A. Mr Nure said several high-level initiatives have been undertaken to address the challenges:

- Privatisation of the telecoms sector, has introduced more actors, such as Kenya’s Safaricom, which makes the sector more competitive;

- The introduction of mobile money services by both Safaricom and local Telebirr and other players;

- Subsidising the cost of mobile devices and making distribution a part of government strategy within public sector management programmes;

- The conceptualisation and implementation of government initiatives as part of the Ethiopia Digital Strategy 2025, which focuses on the shifts towards e-commerce and the digitisation of traditionally non-digital industries. This includes the introduction of digital identification and e-governance, and the expansion of digital payment systems.

The study showed that the government’s approach to digital agricultural extension advisory services, as part of Ethiopia’s National Agricultural Extension Strategy, has buoyed the growth of organisations like Lersha, a one-stop digital service for smallholder farmers, which enables them to access farm inputs, hire mechanisation services and request agro-climate advice using technology. This governmental support has also led to the uptake of the services such as Sprout Content, which partners with farmer-facing organisations to deliver customised expert and scientific content and real-time services that directly address the challenges small-scale farmers encounter.

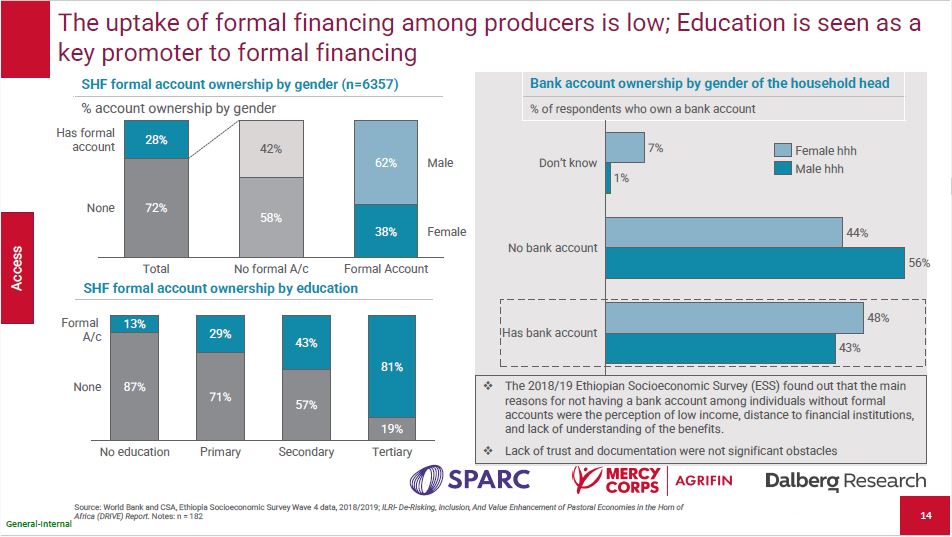

Alpha Ouma Masemba, Dalberg Research Senior Data Analyst and lead presenter during the webinar, added that the research found that some banks and microfinance institutions have adapted digital payment services to encourage producers to use formal financing services. These Institutions include Abay Bank, Abyssinia bank, Cooperative bank of Oromia, OMO Microfinance and Somali Microfinance.

A: Panellist Tilahun Asmare, Program, Performance and Quality Director, Mercy Corps Ethiopia, said that numerous initiatives and partnerships between commercial companies and banks across different regions such as the Afar, Somali and Oromia have been successful in addressing these challenges. For example, Hello Cash which, at the time of the webinar, had registered 1.3 million users and moved 10.7M Birr (US190,000) in daily transactions in the Somali region of Ethiopia alone. He said it is through these same partnerships that banks and other service providers offer digital literacy training.

According to Mr Masemba, the research showed a rapidly growing number of players in AgTech, FinTech and mobile banking in the country. These include Google Africa 118, an online marketing platform offering digital skills training for small and medium-sized businesses in Ethiopia, Kenya and Uganda, and Simprints, a non-profit tech firm that provides biometrics services.

Other significant players include non-profit, research and for-profit tech platforms such as Hello Tractor, M-Pesa Africa (Safaricom), CGIAR, Precision Development, Digital Green and Amazon Web Services.

Q: "What strategies did you use specifically to make sure the study was inclusive of the youth?"

A: Mr Masemba, explained that the study is inclusive of the youth, and added that more than half of the smallholder farmers in Ethiopia are youth. The research also revealed that more than half of the pastoral community household members are aged between 18-34 years and are actively engaged in pastoral activities.

Since the study was conducted exclusively through secondary research, Dalberg Research incorporated findings from relevant programmes, including the Feed the Future Ethiopia Value Chain Activity, which contributes to the Government of Ethiopia’s objective to improve agricultural productivity and commercialisation of smallholder farmers. The research also analysed studies conducted by Cordaid’s ICCO Cooperation under the Strengthening African Rural Smallholders (STARS) initiative. The STARS programme primarily targets youth and women, with a mission to enhance value chains and facilitate improved access to financial instruments for smallholder farmers.

Q: “What is new about this data? Haven’t we heard it all before?”

A: Collins Marita, Director of Monitoring, Evaluation, Research, Accountability and Learning at Mercy Corps AgriFin, said that the research aims to pull together data on how African agro producers use digital information and financial services, offering a single, comprehensive resource to support market actors.

Broadly, these actors include the private and public sector, local and international research centres, academia, local Non-Governmental Organisations, and international development partners. In addition to shaping policy on technology and agriculture (livestock and crops), this research is a useful resource for banks and microfinance institutions, technology firms and mobile and internet service providers, government and donors. These entities create platforms, promote, and/or support the deployment of digital tools and services, giving agro producers access to much-needed advisory and financial services including extension, insurance, and mobile banking services.

The consolidated data aims to ease access to, and contribute towards the growth of innovation and uptake of, digital financial and information services. The research broadly identifies the providers and users of DIS and DFS products, highlighting some incentives and barriers to uptake. It examines the attitudes and behaviour of Ethiopia’s agro producers towards the digital services taking into account their diverse contexts, including pastoralist communities in the country’s drylands. This information is designed to help strengthen the sector by informing the development of digital solutions, shaping policy, identifying investment opportunities, and supporting the growth of an enabling environment for the development and use of DIS and DFS products.

Q. "What’s the way forward?"

A: Ferhana Jelaludin, Programme Engagement consultant for Mercy Corps AgriFin - Ethiopia and one of the panellists, emphasised the need to reframe challenges as opportunities, and the importance of learning from other countries in Africa, Asia and elsewhere. She said: “By seizing the late-comer advantage, we can somehow skip the trial-and-error phase and implement what has already been proven in other countries. One caveat is that the solution has to be tailored to the Ethiopian context and the challenges being experienced locally.”

Speakers also emphasised that problem and context analysis are key starting points. Carmen Jacquez, SPARC Director of Evidence and Learning - Resilient Dryland Production Systems, Horn of Africa, said the most important starting point was to understand the end user, what they need, and whether existing digital solutions to meet their needs already exist. She added: “Digital technologies cannot address all needs, nor is the household the only end user. We often want the pastoralist or smallholder household to be the end user of any digital technology. But first ask yourself whether the household would be better served if the private or public sector had a digital tool that helped them meet a household’s needs.”

She described the complexity of the challenge at hand, saying: “There isn’t one succinct answer to the question on what type of investments can be made to support the adoption of digital solutions in Ethiopia -particularly in the drylands and in pastoralist contexts. We have to layer on all the issues if we want to drive adoption.”

This webinar was the second in a series of three. The first report and subsequent webinar focussed on the Use of Digital Information and Financial Services among Agricultural Producers in Kenya. Dalberg Research, Mercy Corps AgriFin, and SPARC will be launching the third and final report, and hosting a webinar, focussing on producers in Nigeria in February 2024.

Watch the webinar on Ethiopia here:

A Saudi returnee with a mobile phone returns to her home in Ethiopia

Credit Image by Ayene / UNICEF - CC BY-NC-ND 2.0 DEED