Blog

Revolutionising producer livelihoods: opportunities for digital financial and information services to build resilience in Nigeria

Digital financial and information services can transform the livelihoods of agroproducers in Nigeria. This blog - based on a SPARC, Dalberg Research and Mercy Corps AgriFin webinar - explains how.

Publisher SPARC

The third and final webinar in a series launching research on how agroproducers use digital financial (DFS) and information services (DIS) was held in February. The event - on agroproducers in Nigeria - was based on studies carried out by Dalberg Research for SPARC and Mercy Corps AgriFin, as part of a series of webinars to launch studies on how agroproducers in Nigeria, Kenya and Ethiopia access and use DFS and DIS.

The webinar on Nigeria brought together four panellists working in the country around the virtual table to share their experiences of how smallholder farmers, pastoralists and agropastoralists in Nigeria use DFS and DIS. They shared insights on the research findings presented by Daniel Makale, Dalberg Research analyst.

Digital access and usage trends among agroproducers: what, where and how?

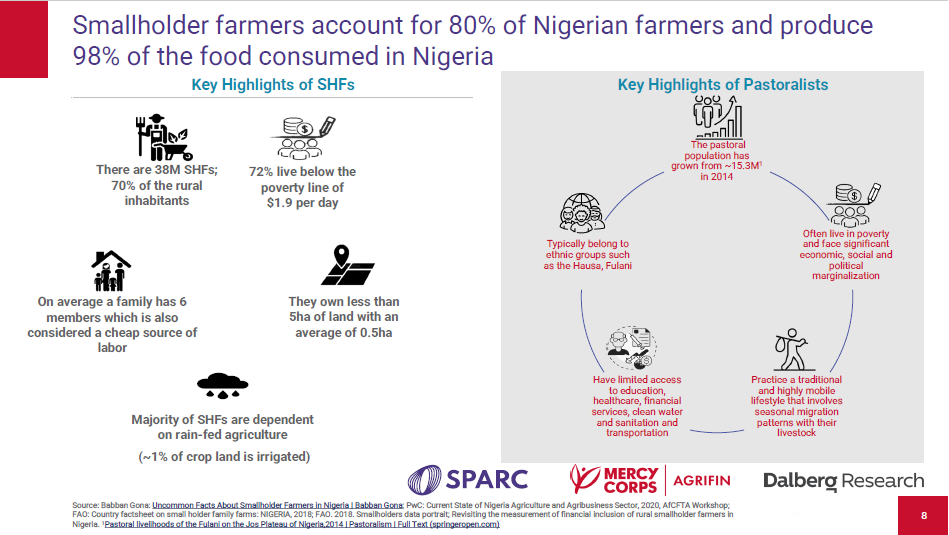

Mr Makale opened the event by giving a demographic overview of agroproducers in a country of more than 218 million people. He highlighted research on access and usage trends for DFS and DIS among smallholder farmers, pastoralists and agropastoralists in Nigeria. The panellists then had the opportunity to engage with the research findings, juxtaposing them against their experiences in their respective areas of work. Their presentations highlighted a range of key issues, sparked vibrant discussion and made some clear calls to action.

Their contributions during the webinar, and in subsequent one-on-one follow up discussions with SPARC, provided practical insights into if, how and where agroproducers and farmer facing organisations are harnessing the power of DFS and DIS to boost productivity, resilience and, ultimately, incomes.

The role of digital tools to drive uptake of targeted data-driven animal health campaigns

During the webinar, panellists spoke of the benefits of DFS and DIS. Gbenga Ariyo, Portfolio Lead for Ikore International Development, emphasised the importance of digital platforms such as Ikore’s Vet Wiz app, which helps Community Animal Health Workers to identify and report diseases using reference photos. Citing the role played by the app in stopping the spread of an earlier rabies outbreak, he added that the timely reporting of the outbreak by Community Animal Health Workers to Ikore and onward to the local administration led to a vaccination campaign around the outbreak zone, which prevented further spread.

He added that the app and an accompanying Kobo Collect Form are effective tools in equipping states with important data to help plan the effective use of resources for interventions; plan vaccination schedules; make a data-driven case for interventions and approaches; and provide an avenue for feedback to livestock farmers.

The experts made a strong case for the use of digital services, but also reiterated factors to consider in planning their use, and highlighted numerous constraints to their adoption. These key considerations in the adoption and use of digital services included:

- Infrastructure - including network coverage and electricity;

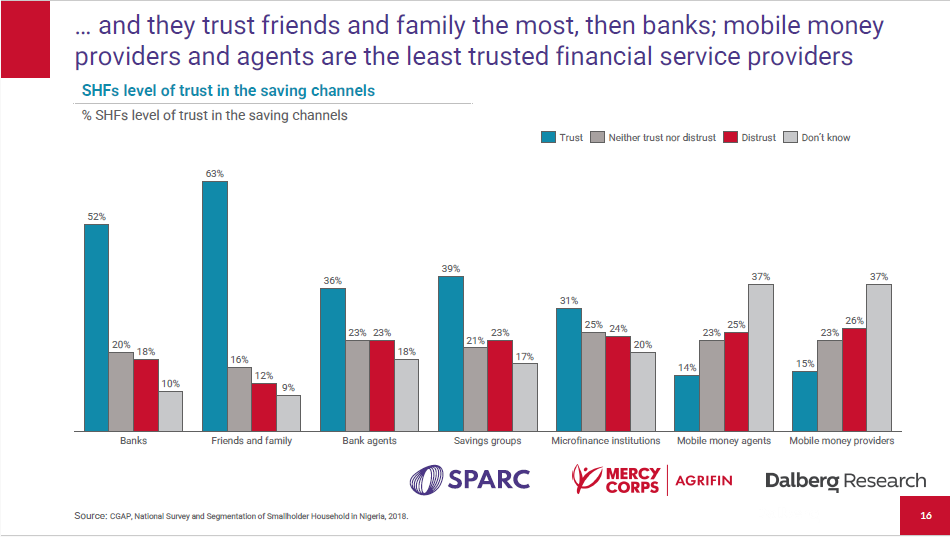

- The need to build trust about DFS and DIS with smallholder farmers, pastoralists and agropastoralists;

- Bundling services for agroproducers to include digital and financial services;

- Device financing - the need to sustainably get devices into more hands, and;

- The need for development organisations to better collaborate and share knowledge to reduce the duplication of efforts.

Poor Infrastructure: Network and electricity coverage

A common theme during all three webinars was the glaring infrastructure deficit in network and electricity coverage in all three countries. Dolapo Olusanmokun, Program Engagement Consultant with Mercy Corps AgriFin, based in Nigeria, pointed out that even though infrastructure development falls within the government remit, it is time to innovate in order to move the needle with regard to the infrastructure and connectivity gap. She called for a shift in the perception and attitude that only the government can solve the problem.

Stating the need to find innovative solutions to bridge the connectivity gap, Ms Olusanmokun gave an example from the education sector, highlighting a 15-year agreement between Telcroft Technologies and Delta State University, Abraka, to offer turnkey campus-wide WiFi connectivity to the university, with the cost of data built into students fees. She pointed out that agroproducers must have access to connectivity and electricity in order for any meaningful progress on DFS and DIS to be made.

Investing in intentional trust building

Perception and Awareness Issues: Phones as tools to help production: experts also agreed that increasing network coverage would not automatically mean that agroproducers would simply overcome the twin challenges of awareness and perception of the digital landscape. With a significantly larger population of agroproducers living in rural, and sometimes remote, parts of Nigeria, many have limited exposure to mobile phones, and are therefore unfamiliar with the digital way of working and communicating.

Ugochi Izuora, Head of Operations at Livestock 247, illustrated why awareness plays a central role in the adoption of DFS and DIS. She said:

“When one of our Livestock Assistants first visited a certain farmer, he watched keenly as the assistant used his phone (keying in data about the animal). After the visit, the farmer complained saying, ‘all this worker did was press the buttons on his phone, he didn’t even look at my animal."

Ms Izuora added that instances like these are the definition of success for Livestock 247. As an implementing partner for Advancing Local Dairy Development in Nigeria (ALDDN), she said that Livestock 247 has been deploying its Animal Identification and Management System (AIMS) using ear tags or microchips to mark and track livestock animals. According to Ms Izuora, livestock farmers now know not to drink or sell milk from animals within a recommended time frame after the livestock have been administered drugs such as antibiotics - proving that digital information services tracking milk quality can work. But, “Change,” she says, “takes time.”

Low trust due to failed digital transactions

Due to the high rate of failed digital payment transactions (where payments are reversed and transactions cancelled for any reason, including network glitches or system failure), agroproducers have been much more reluctant to use digital payments even when they have access. The risk of the loss of cash or product through failed transactions deters many smallholder farmers, who may not have regular access to the internet, know how to escalate a customer service complaint online, have the mobile phone airtime to make the follow up phone calls, or may have their cash held up while they seek redress, from using DFS. Ms Olusanmokun said these barriers reinforced why farmer-facing market actors – including government, aggregators, and development partners – need to do more to build trust with agroproducers to encourage more robust uptake of digital services in Nigeria.

Understanding the cultural context and undertones, and engaging women

For sustainable change to take place, the experts also highlighted the need to prioritise efforts to understand the cultural contexts in which organisations work to implement DFS and DIS. Understanding gender roles and rules of engagement, how communication happens, who is trusted, who holds influence, and how they use it in farming, pastoralist and agropastoralist communities is paramount when establishing trusted relationships to encourage agroproducers to adopt innovative digital approaches. Citing how technology could be used to give women who experience culture-based mobility restrictions an opportunity to engage more in society, Ms Izuora gave an example of the Paysabill app, which was developed to enable women to meet their religious obligations on charitable giving from the comfort of their homes.

The panellists all emphasised the importance of developing clear strategies to engage women agroproducers in and through the use of DFS and DIS. After the event, Mr Ariyo said that Ikore is committed to training women as Community Animal Health Workers, successfully doing so in Gombe State - with 30% of all recruits being women, and Bauchi State - with 40% of recruits being women. However, in other states, such as Jigawa State, the administration has banned women Community Animal Health Workers altogether. Ms Izuora said the gender lens must be used with a clear understanding of the cultural context, and with a participatory approach that includes the women in the community. She added that listening to their values, pain points and aspirations before designing interventions was crucial to avoid creating harmful and cultural disruption that may lead to a harmful backlash against the women.

Bundling of services

During the webinar, Chukwuma Kalu, Commercial Manager for Anglophone West Africa at Pula Advisors, said that their organisation's strategy involves working with partners, such as Babban Gona and AFEX, which have already established trust and credibility in Nigeria. He emphasised that there is no need to reinvent the wheel by creating new entities to market their livestock insurance packages.

Mr Kalu added that Pula’s crop and livestock insurance is parametric and caters to the needs of smallholder agroproducers and protects them from floods, drought and wind damage. He said that efforts to engage over one million smallholder farmers could only be realised if intermediary organisations such as financial institutions and aggregators were also involved. He said that Pula leverages technology by using remote sensing tools to do most of the heavy lifting and only puts boots on ground when necessary, and reiterated that trust is an important component, as well as the economic sense of these mutually-beneficial relationships to provide bundled services.

Device financing and future collaboration

Experts also explored access to digital devices, opening the conversation by discussing some of the different initiatives that have been launched in Nigeria to put phones in the hands of agroproducers using a sustainable model. Ms Olusanmokun said that finding a model that works is key, based on research on agroproducers' disposable cash, the price point of the phone and viable payment plans. Companies like M-Kopa have made huge strides in the Nigerian market, offering relatively affordable phones, and are equipped with technology that allows the company to shut down the phone in event that the buyer defaults on payments.

But she added that new, innovative approaches are also possible. These include increasing agroproducer access to DFS and DIS through ATM channel integration and cash agents. Located in spaces such as inputs suppliers or AFEX warehouses, smallholder farmers could safely make financial transactions by engaging with people they trust. This alternative model was just one of many that would allow agroproducers without mobile phones to safely make digital transactions, Ms Olusanmokun said.

At the close of the webinar, Sieka Gatabaki, Mercy Corps AgriFin Program Director, echoed calls for better collaboration among stakeholders in the development sector to avoid duplication of efforts and to allow reasonable information sharing. He also reiterated his interest in comparative research looking at the three countries which were studied - Kenya, Ethiopia and Nigeria - and exploring the similarities and differences in the access and use of DFS and DIS in those markets.

Watch the webinar on Nigeria here:

Credit Graphic by SPARC